Condominium coverage - The Hanover Insurance Group - Questions

NEA Condominium Insurance - NEA Member Benefits

Getting My Condo Insurance - Get a Free Online Quote - Liberty Mutual To Work

Although HO-5 is similar to HO-3 in terms of protection, there are a couple of important differences in between the two kinds of home insurance coverage. While HO-3 just provides open-peril protection on the home's structure, HO-5 functions open-peril coverage for personal valuables, in addition to the structure of the home. After filing This Is Noteworthy , HO-5 pays the replacement cost of the covered item, while HO-3 only replaces the item's actual worth.

Other differences between the 2 policies can vary by insurer. While policies can differ by insurer, HO-5 policies are usually more expensive than HO-3, and fewer homes are eligible for an HO-5 policy. HO-8 Older House Kind HO-8 policies are typically used to cover houses that are 40-years old or older.

Condo Insurance Vernal, UT - Eastern Utah Insurance

So, insurance provider utilize this type of home insurance to provide budget friendly protection to individuals who own older homes. Like HO-1 and HO-2, older house insurance coverage uses named-peril policies. HO-8 policies usually cover house, personal property, liability, and loss of use from named dangers. The called dangers consisted of in a HO-8 policy are the exact same perils named in an HO-1 policy.

The Ultimate Guide To What is Condo Insurance?

Tenants Insurance Coverage HO-4 Tenant HO-4 policies are frequently known as tenants insurance coverage and provide coverage for occupants who desire insurance for their rented residence. The purpose of this kind of policy is to protect items within the residence, along with any permanent fixtures like cabinets that were set up by the occupant.

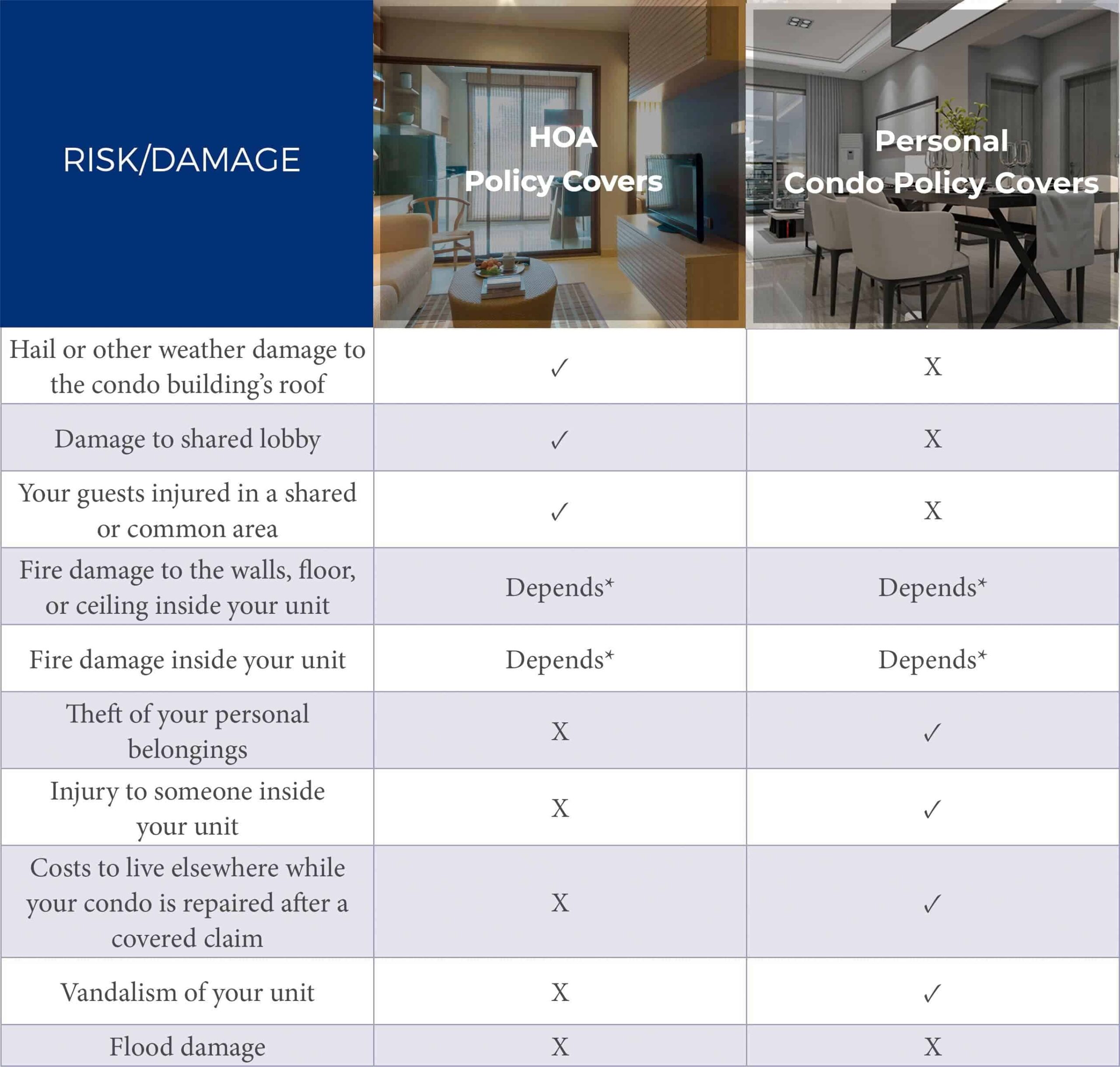

Renters insurance coverage generally provides protection for individual home, liability, medical payments to others, and additional living expenditures arising from loss of usage. Aside from irreversible components inside the house set up by the renter, HO-4 does not supply coverage for any structures. Condo Insurance Plan HO-6 Condo Form HO-6 policies use protection for condominiums.

Condominium insurance generally utilizes a named-peril policy, but some insurer will enable the coverage to be reached an open-peril policy, which will likewise indicate paying a higher premium. HO-6 policies will typically offer protection for constructing home, personal effects, personal liability and loss of usage. Like other kinds of house insurance, HO-6 usually doesn't cover flooding, and additional coverage will need to be bought if flood insurance coverage is preferred.